Make Money

Dollar Cost Averaging Explained & Why It Works for Investing

You’re not alone if you’ve ever felt unsure about when to invest, especially when all you read (or experienced) in early April was how the market tumbled and everyone’s retirement accounts lost between $23K and $76K in value. For example, I “lost” $60K, but since I didn’t panic sell, I didn’t actually lose anything.

Since timing the market is notoriously difficult, even for professionals, there IS a way to invest that removes the pressure of trying to get it right. “Time in the market beats timing the market” is a phrase that gets used a lot, but it’s completely true. And you can do this by Dollar Cost Averaging or DCA for short. It’s a simple, consistent, investing strategy that helps you grow your money over time without the stress of marketing timing.

Let’s go over what DCA is, how it works, and why it’s useful for long-term investors!

What is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging is an investment strategy where you invest a fixed amount of money at regular intervals, like monthly or bi-weekly, regardless of what’s happening in the market. Instead of trying to pick the best day to buy, you just spread out your investments over time without letting your emotions dictate your actions.

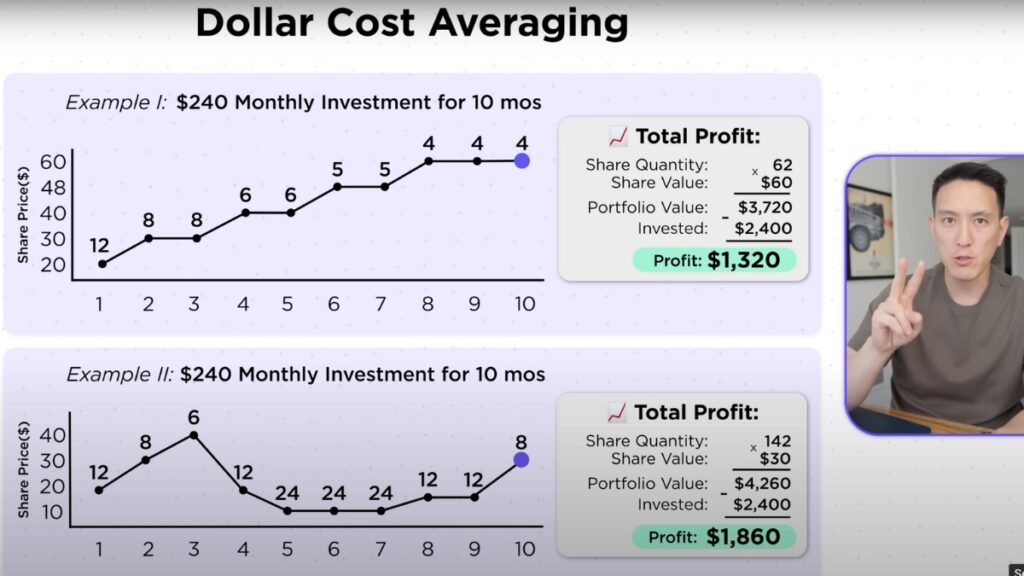

For example, let’s discuss Humphrey Yang’s sample charts below and say you’re investing $240 a month for 10 months.

At a glance, you would think that the chart on top is the most ideal scenario for investments because the price per share line keeps going up.

But when you look at the numbers, the bottom chart is the one that resulted in more profit.

This is because in some months, the price per share might be high, and you’ll buy fewer shares with your $240. But in other months, as the bottom chart shows, prices can drop giving you the ability to scoop up more shares with that $240.

In both charts, the amount you’ve invested is the same: $2,400 because you had decided on $240 for 10 months. However, the shares and portfolio value increased in the bottom chart because you were able to pick up more shares during the down months.

If emotions had taken over during the down months, you might’ve sold off the investments instead of contributing per normal and letting it ride out back to recovery. By DCAing, your average cost per share is lower than the highest price you paid, which is why it helps reduce your investment risk over time.

Why Dollar Cost Averaging Works

1. Reduces risk of market timing

Instead of attempting to predict the market’s highs and lows (put away that non-existent crystal ball), you’re investing steadily and letting the market fluctuations work in your favor.

2. Builds consistency

DCAing encourages the habit of investing regularly, which is key to the longer-term success. Small, steady wins add up!

3. Strengthens emotional discipline

No emotional rollercoaster and FOMO trades with this method. Just calm, regular investing to stay the course during any market volatility.

4. Encourages long-term thinking

Investing is a marathon, not a sprint, so think in decades instead of days. This is the slow & steady method adopted by calm investors and practiced by the wealthy.

Best Types of Investments for DCA

The DCA method works well with:

- Index Funds – These funds track a market index which is great for diversified, low-cost investing

- ETFs (Exchange-Traded Funds) – Similar to index funds, but traded like individual stocks

- Mutual Funds – Professionally managed investment vehicles that pool money from a lot of investors

- Retirement Accounts – 401(k)s and IRAs typically use automatic contributions, which makes DCA naturally a fit

When DCA Might Not Be The Best Choice

The opposite of DCA is lump sum investing, which is where you invest all your available money at once rather than spreading it out over time. While DCA is great for many investors, it’s not always the top-performing option because statistically, lump sum investing results in higher returns due to more money being in the market.

You can think of DCA as less about maximizing returns and more about reducing emotional mistakes and smoothing out volatility. If you received a large bonus or inheritance, you can try a hybrid approach where you invest part of it right away in a lump sum, and then DCA the rest over time.

How to Set Up a DCA Strategy

1. Determine your budget

Figure out how much you can invest consistently without affecting your essential spending and other goals

2. Choose the investment platform

Most brokerages and apps let you easily set up recurring investments

3. Pick your investments

Focus on diversified options like ETFs or index funds

4. Automate the process

Set up auto-transfers from your bank account or paycheck

5. Stay consistent!

Stick with the plan don’t let market conditions sway you

Know that you don’t need thousands of dollars to start. Even $50 a month will make a difference over time, and you can always add more later when you’re more comfortable with the process.

Market ups and downs are completely normal, so ignore the noise and stay the course. When markets are down, you don’t lose if you don’t sell. Just check in on your goals annually and adjust if needed.

The Money Move

Dollar Cost Averaging is a beginner-friendly way to invest consistently and thoughtfully. No matter your age, this type of strategy helps reduce risk, smooth market bumps, and build long-term wealth. Start however you can, invest whatever you can, and let time and compound interest do the rest! You’ll be glad you’re not trying to time the market but staying in it to grow that wealth.

Here’s the full video that inspired this post: